The Home Loan

For People Tired of Wasting Money on Utility Bills...

Lowtility is the mortgage that goes after the energy bills driving up the cost of owning a home. How? By rolling energy upgrades into the loan and turning unpredictable utility bill into a lower, more efficient monthly cost.

A Home That Costs Less

Less Waste. More Control.

Stop Overpaying the Utility Company

We Get It...

Energy efficiency sounds smart, but paying for it feels out of reach...

Most people think adding energy upgrades will raise their monthly cost, not lower it.

Homeowners want lower bills, but don’t have the cash to fix what’s driving them up.

Energy upgrades stall because they require cash most homeowners don’t want to spend.

Utility bills are turning affordable homes into financial stress.

Most homes are financed as if energy costs don't matter,

even though they show up Every Month

Traditional mortgages focus on the purchase price,

but ignore what it actually costs to run the home.

That’s the gap Lowtility was built to fix.

It’s a home loan designed around

the true cost of owning a home

(Mortgage Payment AND the Utility bills)

Instead of financing a home and ignoring energy costs,

Lowtility combines both together.

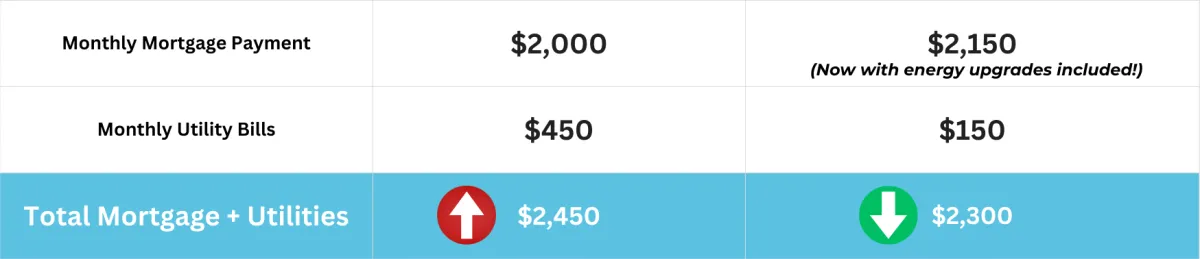

How Lowtility Changes the Math

Lowtility treats energy like part of the home—not an extra expense.

Instead of asking homeowners to pay cash for energy upgrades later, Lowtility allows

those upgrades to be financed as part of the mortgage.

The result is simple:

The home becomes

more efficient

Utility bills Go down

Total Monthly Costs

Often Improve

What makes Lowtility

Different?

Energy upgrades are planned upfront, not postponed

Utility waste is addressed instead of ignored

Monthly costs become more predictable

The home is cheaper to own over time

This isn't about adding features.

It's about removing wasted money.

It Sounds Backwards at First...

But when the energy savings are larger than the added loan cost, the math starts working in the homeowner’s favor.

That’s when an “affordable” home becomes a "sustainable" one.

Want to see if this works for Your home?

A quick conversation can show whether lowtility makes sense for your situation.

Equal Housing Lender. Credit and collateral subject to approval. Program terms vary.

What Changes with Lowtility?

When energy costs are designed into the loan, the impact shows up NOW, and grows over time.

Short Term

Results

Lower Total Monthly Housing Cost

Many homeowners see utility savings that offset more than the added loan payment.

More Predictable Bills

Energy costs are reduced and stabilized instead of fluctuating month to month.

Less Waste. More Control.

Money stops leaking to the utility company and stays working for the home.

Long-Term

Benefits

Protection from Rising Power Costs

As utility rates continue to climb, the value of energy savings grows over time.

More A Home that Get's Cheaper to Own Each Year

Efficiency improvements keep paying you back long after they're installed.

Stronger long-term affordability

Money stops leaking to the utility company and stays working for the home.

** Results vary by home, usage, and location.

energy efficient upgrades you can wrap into your mortgage:

Solar

Batteries

Smart home panels

Energy Efficient Appliances.

Energy efficient Water Heaters.

Tankless water Heaters

HVAC

Insulation

Windows

Doors

Geo Thermal.

Led Bulbs

Window film or Cellular shades

Duct sealing

Ceiling fans

Heat Pump

Mini splits

Lower Utilities = Lowtility.

**The energy upgrade is done as an Escrow Holdback. Meaning your home purchase or refinance is funded, the money is set aside for the work to be completed after. For Home buyers specific: The seller doesn’t have to approve or authorize any of the energy improvements.

Here's a real clients story...

Before

Lowtility

After

Lowtility

The mortgage payment increased slightly.

Utility bills dropped significantly.

The result: A home that costs less to own now—and becomes more affordable as energy prices rise.

** Results vary by home, usage, and location.

Who is Lowtility for?

Anyone dealing with High Energy Bills that makes homes hard to afford:

Homebuyers

Buying a home without draining savings

You care about the full monthly cost, not just

getting approved.

Homeowners

Tired of Rising Utility Bills

You want a home that costs less to own, not more over time.

Real Estate Agents

Helping buyers qualify and close

You need real affordability solutions that move deals forward.

Builders& Developers

Delivering homes that perform better

You want differentiation without cutting margins or adding risk.

Solar Professionals

Efficiency works - but financing gets in the way

You need a homeowner-friendly way to pay for upgrades.

What Homeowners say

about lowtility

See What our happy customers had to say about their experience.

After servicing over $100 billion in mortgage loans, we saw the same problem over and over.

Solar & Energy Efficiency Work...

The Way They've Been Financed, Hasn't.

For years, homeowners have been pushed into solar loans and leases with:

Inflated finance fees

Confusing terms

Restrictions when selling or refinancing

Extra liens on their homes

Payments that don’t actually lower total monthly costs

That’s why many people hear “solar” or “energy upgrades” and immediately think risk.

They’re not wrong

Lowtility is not a solar loan

It supports energy upgrades that reduce operating costs and are structured to protect:

Affordability

Flexibility

Resale and refinance options

The goal isn’t to sell equipment.

It’s to lower the total cost of owning a home.

What happens next?

You don't need to decide anything today.

And you don't need to commit to anything upfront.

The next step is simply to see if Lowtility makes sense for your situation.

A short conversation can help determine:

Whether energy upgrades could lower your total monthly cost

What options might be available for your home or purchase

If this approach fits your goals now or later

If it does, great.

If it doesn’t, you’ll still leave with clarity.

Built for real people and real budgets

A Proprietary Mortgage Product

Works within standard underwriting

Designed for long-term affordability

Equal Housing Lender. Credit and collateral subject to approval. Program terms vary.

Before vs After

How the Math Changes

When energy costs are designed into the loan, the impact shows up NOW, and grows over time.

Before Lowtility

Mortgage payment looks affordable

Utility bills are separate and unpredictable

Energy waste stays hidden

Upgrades feel too expensive to fix

Total monthly cost keeps creeping up

Homeownership feels harder than expected.

After Lowtility

Energy upgrades are built into the home loan

Utility bills drop and become more predictable

Waste is reduced instead of ignored

Monthly costs are designed together—not separately

The home costs less to own over time

Homeownership feels more stable and manageable.

The key difference:

Traditional financing ignores energy costs.

Lowtility designs for them.

** Results vary by home, usage, and location.

Ready to see how Lowtility works for you?

Learn More About Home Affordability

How Lowtility Works: Step-by-Step Guide to Smart Home Buying

Learn how Lowtility helps homebuyers combine their home purchase and energy upgrades into one streamlined loan — increasing buying power and lowering monthly costs. ...more

Homebuyers

October 07, 2025•2 min read

Are You Shopping How You Power Your Home

Most people carefully shop for their mortgage rate, their car loan, even their cell phone plan. But very few ever stop to ask: “Am I shopping how I power my home?” With electricity costs rising, solar... ...more

Homebuyers ,Solar Reps &Home Owners

September 19, 2025•4 min read

Hedge Funds Are Buying Your Power Bills. Should You?

Hedge funds are buying utilities—not by accident, but because they see where the money is going: rising electricity demand. AI data centers, EVs, and electrification are pushing power use higher, and ... ...more

Homebuyers ,Solar Reps &Home Owners

August 25, 2025•6 min read

Join The Movement

Follow us on social media @Lowtility

MENU

CUSTOMERS

SOCIAL

© 2025 Lowtility. All Rights Reserved.

Lowtility is the name of a suite of mortgage loan programs designed to allow qualified borrowers to make home energy improvements to their home. It is not affiliated with a utility company or a DBA. Primary Residential Mortgage, Inc. NMLS#: 919520 Utah DRE Mortgage Office License # 8335595. MLO 0117736. MC3094-122. All loans subject to credit and property approval. PRMI NMLS 3094. PRMI is an Equal Housing Lender. Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. 1165 East Wilmington Avenue, Suite 250 Salt Lake City, UT 84106